The real estate market is a dynamic entity, shaped by numerous factors ranging from economic conditions to urban development and policy changes. By examining recent data on property sales, lot sizes, sale prices, types of properties, and structural characteristics across districts, we can gain valuable insights into the current state and future direction of the market. This article delves into the trends highlighted by the latest real estate data, offering a comprehensive overview of what these patterns mean for buyers, sellers, developers, and investors.

Property Sales Hotspots

The data reveals significant activity in specific locations, with addresses like 1660 N Prospect AV and 106 W Seebboth ST leading in the total number of properties sold. Such hotspots indicate areas with high demand, potentially due to their desirable location, amenities, or investment opportunities. A visual map of properties sold highlights these areas, offering a clear view of where the market is most vibrant.

Shifting Lot Sizes and Sale Prices

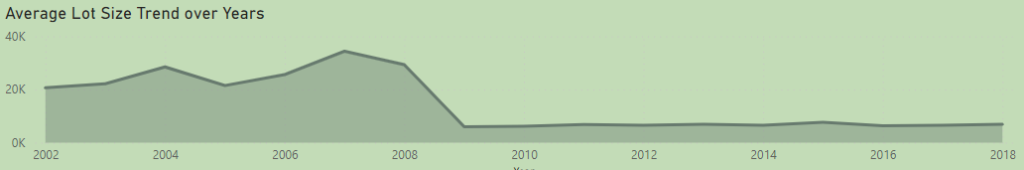

An intriguing trend emerges from the analysis of average lot sizes and sale prices over the years. Initially, lot sizes showed an increasing trend up to 2007, followed by a dramatic decrease in 2009 and a stabilization in subsequent years. This fluctuation may reflect changing urban development priorities, such as a shift towards more compact, efficient land use or variations in market demand for property types. Similarly, the average sale price has experienced its own rollercoaster, peaking significantly in 2008 before plummeting in 2009 and gradually recovering thereafter. These price dynamics could be influenced by the broader economic climate, including the 2008 financial crisis and its aftermath, affecting buyers’ purchasing power and investment strategies.

Diverse Property Types: A Closer Look

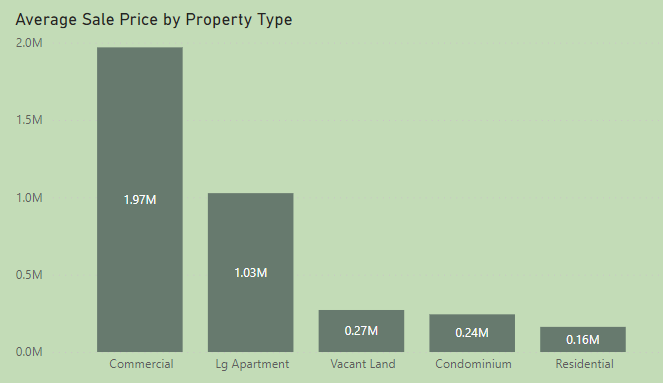

The count of property types—spanning residential, condominium, commercial, large apartments, and vacant land—paints a picture of a diverse real estate market. Each property type contributes uniquely to the market’s overall complexion, with residential properties dominating in number, followed by condominiums and commercial spaces. This diversity indicates a multifaceted market catering to various needs and preferences, from individual homeownership to investment and commercial use.

Structural Features and Property Values by District

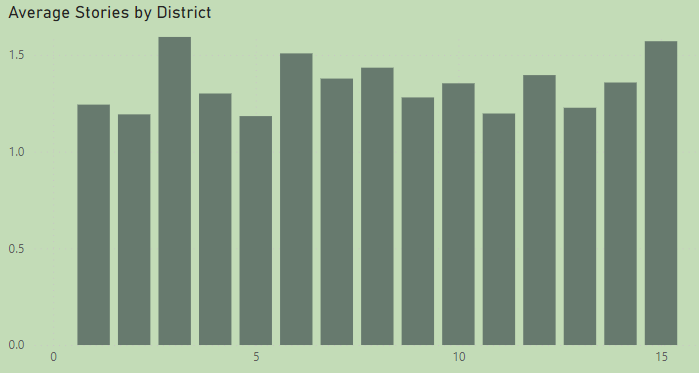

Analyzing average stories by district and average sale prices by property type offers further insight into market segmentation. Districts vary in their average number of stories, indicating differences in building types, zoning regulations, and urban density. Moreover, commercial properties and large apartments command the highest average sale prices, underscoring their significant value proposition in the market, whereas residential properties, despite their volume, show lower average prices, reflecting a wide range of housing options available to buyers.

Conclusion

The real estate market is a complex ecosystem influenced by a multitude of factors. The current trends suggest a market that is not only recovering from past economic shocks but also evolving in response to changing demographics, preferences, and urban development goals. For stakeholders in the real estate sector, understanding these trends is crucial for making informed decisions, whether it’s for buying, selling, developing, or investing in properties. As the market continues to adapt and grow, staying abreast of these trends will be key to navigating the future of real estate successfully.